Like most major markets in the United States, August tends to bring a moderate slowdown in the Charlotte, NC real estate market, and this year has been no exception. Although there has been a moderate dip in year-over-year closed sales, Charlotte real estate trends continue to move upwards in terms of median sales price, indicating the area market shows no signs of slowing down.

Data shows a local uptick in the demand for building materials, giving would-be home buyers hope that new builds might help provide a greater range of options in this highly competitive market.

Prices Continue to Climb, Total Inventory Shrinks

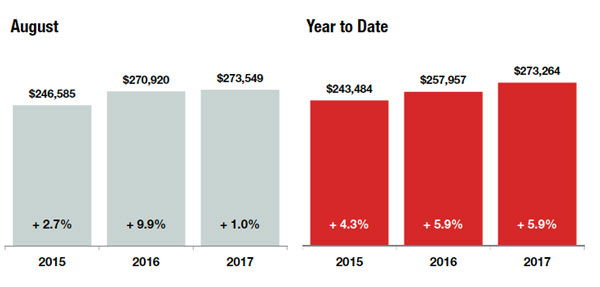

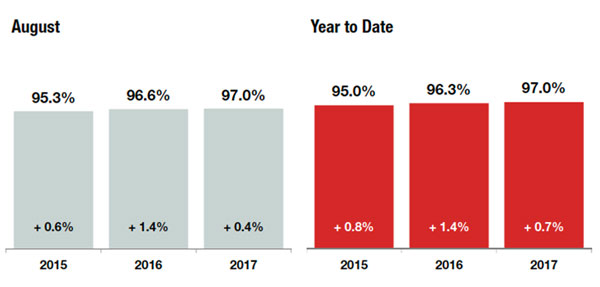

This August, the median sales prices of residential properties in Charlotte rose to $230,000, up 5.0 percent from $219,000 in August, 2016. The year-to-date stats on the percentage of homes sold at, or above the original listing price rose 0.7 percent over the previous year to 97.0 percent, meaning buyers in Charlotte shouldn’t expect any deep discounts when purchasing their next home.

August 2017 Average Sales Price

Overall, the total inventory of homes for sale in the Charlotte region is down from 12,477 at this time last year to 10,153, creating a 18.6 percent decline in the number of residential properties listed for sale in August, 2017.

These Charlotte real estate trends have led to increased competition for available homes, leading to an 8.7 percent year-over-year drop in the days on the market to sale from 46 to 42, along with a 8.2 percent decline in the list-to-close days from 98 last August to 90 in August, 2017.

Demand Outstrips Increase in New Listings

The number of new listings in Charlotte, NC increased to 5,394 from 5,089, a gain of 6.0 percent compared to August 2016. This gain in available homes has helped to keep the average listing price increases below double-digit numbers. However, even with the uptick in available homes, demand continues to outstrip actual supply in the Charlotte area, fueling fears of a critical shortage of housing in the region.

Percent of Original List Price Received

In fact, despite a rise in new listings, there were 18.6 percent fewer homes available at the end of August 2017 when compared to the end of August 2016.

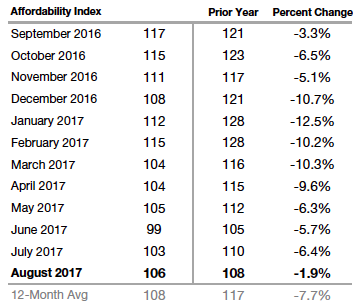

Over time, Charlotte real estate trends are revealing buying a home in the area is becoming slightly less affordable, with the year-to-date housing affordability index shrinking to 107 from 115 in 2016, and 116 in 2015. The higher the housing affordability index, the more affordable homes in the region are.

Over time, Charlotte real estate trends are revealing buying a home in the area is becoming slightly less affordable, with the year-to-date housing affordability index shrinking to 107 from 115 in 2016, and 116 in 2015. The higher the housing affordability index, the more affordable homes in the region are.

Current Mortgage Rate Trends

The current mortgage rates in Charlotte, NC for a 30-year fixed rate loan are listed at an average of 3.76 percent, down from 4.01 percent in July, 2017. These rates are closely linked to the national average rates which are virtually identical to what buyers in the Charlotte area have access to.

Charlotte real estate trends continue to show strong, steady demand for both new and resale properties, making this area truly a seller’s market. With the ongoing shortage of new listings, limited inventory, and rising prices, buyers here should expect to pay at least the asking price on a home and perhaps even plan on being involved in a bidding war.

Leave a Reply